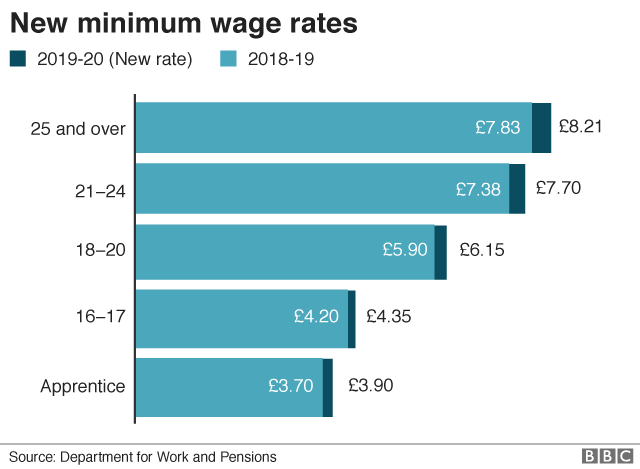

The National Living Wage (NLW) and National Minimum Wage (NMW) increased from 1 April 2019. From that date, the NLW, payable to workers aged 25 and over, is set at £8.21 per hour. Workers under the age of 25 and over school leaving age must be paid the NMW appropriate for their age. From 1 April 2019, this is £7.70 per hour for workers aged 21 to 24, £6.15 per hour for workers aged 18 to 20 and £4.35 for workers above school leaving age and under 18. A separate rate of £3.90 per hour applies to apprentices under 19 and to apprentices over 19 and in the first year of their apprenticeship.

Who is entitled to the minimum wage?

Workers over the school leaving age are entitled to the minimum wage. This is the last Friday in June of the school year in which they turn 16. Once a worker reaches the age of 25, they are entitled to the NLW.

Payment of the minimum wage is not limited to full-time employees. Workers for NLW and NMW purposes also include:

- part-time workers

- casual labourers

- agency workers

- workers and homeworkers paid by the number of items that they make

- apprentices

- trainees

- workers on probation

- disabled workers

- agricultural workers

- foreign workers

- seafarers

- offshore workers

However, company directors without a contract of service fall outside the minimum wage legislation, as do the self-employed, volunteers and voluntary workers, workers on a government employment programme or pre-apprenticeship scheme or certain EU programmes, members of the armed services, family members living in the employer’s home, non-family members living in the employer’s home who are not charged for meals or accommodation and treated as a family member (for example, an au pair), higher and further education students on placements of up to one year, people on a Jobcentre Plus Work trial for six weeks, share fishermen and those working and living in a religious community.

It is important to identify which workers fall within the scope of the minimum wage legislation and pay them accordingly.

What is included in the minimum wage?

Certain items are not taken into account in determining whether a worker has been paid at or above the relevant minimum wage for his or her age. These include payments for the employer’s own use or benefit, items that the worker has bought for the job and which have not been reimbursed, such as tools, a uniform and suchlike, tips and service charges and any extra pay for working unsocial hours on a shift.

However, income tax and National Insurance are taken into account in the minimum wage calculation as are advances of wages or loans, repayment of overpaid wages, items provided for the employee which are not needed for the job, such as meal and penalty charges for a worker’s misconduct.

Accommodation

Accommodation provided by the employer is taken into account when calculating the minimum wage. The legislation provides for an accommodation offset, set at £52.85 per week/£7.55 per day from 1 April 2019.

If the employer charges more than this for accommodation, the excess is taken off the worker’s pay which counts for minimum wage purposes. Where there is no charge for the accommodation, the offset rate is added to the worker’s pay.

Failure to pay minimum wage

It is a criminal offence not to pay the National Minimum Wage or National Living Wage to which a worker is entitled. Employers who pay below the minimum wage should pay arrears immediately. Penalties may also be charged.